Rockton, Illinois

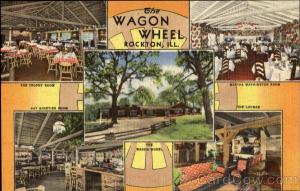

Rockton is a small town (population 7,685) located in the Rock River Valley in northern Illinois. It’s a pretty town on the normally placid Rock River. In past years, Rockton was the site of the Wagon Wheel Resort, started by the late Walt Williamson in 1936 as a gas station and restaurant. It grew into an over 300 acre resort:

Like so many other things, the Wagon Wheel survived because of the entrepreneurial leadership and personality of one person. When Williamson died in 1975, the resort began a slow decline. By the later 1990’s, it was a sad abandoned site. Curtains hung out of broken windows. Piles of debris were everywhere. Arsonist vandals had taken a liking to the place; there were several mysterious fires.

The City of Rockton finally was able to demolish the structures which remained on the site. A vision had made this place alive and when that visionary passed on from this life, the idea finally died.

A New Start

Now, on the top of the highest hill of the Wagon Wheel site stands a modern-day structure:

This 30,000 square foot building is in the architectural style of our day, with clean lines and large windows. But when you approach the building, you discover that it is empty, abandoned as was the Wagon Wheel before it.

You draw close to the entrance. The sign on front says “fatwallet.com”:

The building is empty, but there is the hum of HVAC machinery. Inside, everything is tidy, but there are no people, no furniture, nothing but the structure itself. It is in a beautiful place:

Fairness

Why would a company leave a place such as this? FatWallet.com is still in business, but left Rockton, Illinois as a result of a stroke of a pen on March 10, 2010. On that date, Illinois Governor Pat Quin signed the Illinois state version of the Main Street Fairness Act. To wit:

Under the new law, called the Main Street Fairness Act, online retailers must collect and remit sales taxes on purchases made by Illinois residents if the online retailer has a physical presence in the state. The new law expands the meaning of “physical presence” beyond a warehouse, factory or office to include affiliate companies, typically deal and coupon website operators that earn commissions for directing shopping traffic to an online store.

And:

The U.S. Supreme Court ruled in 1992 that companies without a physical presence in a state aren’t required to collect state sales taxes.

And:

Amazon, based in Seattle, sent a letter to its affiliates in Illinois [including FatWallet] on Thursday telling them that the company will terminate their contracts April 15. Its affiliates will no longer receive advertising fees for sales referred to Amazon.com, Endless.com or SmallParts.com, the letter said.

Needless to say, Illinois’ interpretation of “physical presence” has been expanded. FatWallet, faced with a loss of revenue, quickly resolved the issue by moving two miles away into Beloit, Wisconsin. Wisconsin does not charge a similar sales tax.

FatWallet.com

To quote FatWallet.com’s founder, Tim Storm: ““We exist to help people save money.” In so many ways, FatWallet is the classic start-up, begun in its founder’s basement in nearby Rockford with capital of $100.00 (the cost of a domain name for three years). Along the way, the business was built up into what it is today. The company started with one employee, and now has around 60 employees. Those people brought money into the local economy, paid taxes, added value. Their story is here.

In the larger sense, start-up companies such as FatWallet exist because they are willing to look at things in a different way. The company happened to do so at the right moment. At the same time, the State of Illinois was in its own process of expansion by increasing taxes. More than a few companies including Caterpillar are making plans. The increases in taxes also affected individuals.

How you feel about these moves depends upon your political perspective, but what many politicians are unwilling to acknowledge is the fact that people are not necessarily going to sit there quietly and pay those new taxes. It is not against the law to minimize your tax exposure; there are countless estate planners who work very hard at this every day. Lawyers are standing by, too. In short, if the tax situation becomes unfavorable, people will respond by either lowering their exposure or by moving. FatWallet moved to another state.

Hidden Taxes

You can’t turn around without running into hidden taxes. Every time you rent a car, or stay in a motel, there are little fees and taxes enacted by local governments. At the same time, you have no elective voice in the governments which have enacted these taxes. You simply return the car at the airport, get on a plane to leave (paying more taxes along the way) and go home.

The notion of state taxation of interstate commerce has now moved to the national level courtesy of Dick Durbin, Senior Senator from the great State of Illinois. The proposed law’s name, as was the State’s law, is the “Main Street Fairness Act”. It sounds so wholesome. You can just see it in your mind’s eye.

- Ed, the town’s pharmacist is out in front rolling down the canvas awning of his store. Miss Primm, the town’s librarian says hi to him as she walks to work. Down the street, Flo dusts the books on the shelves of her little shop, while Buddy sweeps out his hardware store. Jim and Earnest sit on nail kegs playing checkers out in front of the barbershop.

Even the Senator is joining in the fun:

It needs to be fair for the good folks of Main Street!

Like so many other political fantasies, you do need to take this sort of thing with a grain of salt. Or three. Consider that big stores like Wal-Mart actively support the Main Street Fairness Act because they are both brick & mortar and online. As opposed to Amazon, that is only online, selling interstate and not paying taxes to the state governments. Is this fair? Your call, but when tax collections go up, the money has to come from somewhere. And there are consequences to tax increases.

In the larger sense, FatWallet is simply a pawn in the game of life, but the pawns are truly the most useful players because they determine the strategic flavor of a game. A well placed pawn can help win a game, a poorly placed one will lead to quick defeat.

FatWallet is part of a larger process of how we obtain goods and how we look at our world. They are nimble and able to change their business model to reflect the needs of a free market. And they generate jobs and related income at a time when we most need it. While not big in the financial sense, FatWallet and other such operations are giving people information which helps them save money. And money not spent on one thing can be spent on something else. Or saved for future use.

There is a downside to having so much information available, but the process started before the Internet. In the movie “You’ve Got Mail“, the tiny soulful little children’s bookstore gets eaten up by the big evil megastore. A lot of the little book stores have fallen by the wayside because of big brick & mortar stores such as Barnes & Noble and Borders. Yet, even the big, bad super bookstores are now feeling the pinch, too. And it wasn’t necessarily the Internet that did it. You have to acknowledge that popular tastes change with time. A free market changes.

Crony Capitalism

While a free market changes in response to demand, there are a lot of forces out there trying to push things one way or another. We live in confusing times, and there are a lot of special interests out there who are playing everything for what it’s worth. Yet, we as a society have relied upon the for-profit entrepreneurs to affect change. And for the government to largely stay out of the way while they did it.

Consider that if movie theater owners in the 1950’s had been able to limit their competition, there might not be television. At least not television as we know it. Likewise, if there had not been Ted Turner, there might still just be ABC, CBS and NBC and boring “educational TV”. I trust the free market to handle things better than I trust a small group of politicians who are being constantly pulled in different directions by special interest lobbyists waving money at them.

This is not to say that the market always makes the right decision. The war between the 1980’s video formats of Betamax and VHS is an example. While Betamax was technically superior in video quality, it was VHS which won the market place. There were a number of reasons why, including the presence of pornography on VHS, yet however wrong it might have been, the market spoke eloquently. Now, upon sufficient reflection, video tape seems so, uhh, 20th Century. The free market moves on.

For years, while the economic bubbles were swelling, we heard the mantra “There must be reward for risks taken.” Now, however, when the risks turned around and started biting these “entrepreneurs”, they have fled to the government to bail them out. Rather than accept that the risks they had taken were unjustified which led to their financial losses, they now have sought the taxpayer to make their investment pay. They now try to stifle the actions of a free market.

Likewise, the clear line between private enterprise and public service has been blurred, if not erased. People work in government service for a few years, then hop right over to industries that they once regulated. Or people work in private enterprise, make a bunch of money, contribute to a candidate and then they miraculously get a nice government posting. This has been going on for years, with both political parties, but now it seems that people make big political contributions and now become vendors to the government. Or get big loans from government agencies to support their private businesses. This is not right, and most everybody knows it, but the practice continues.

People who read these pages know that I’m a private-capital, free-market guy. Not that its been all that easy in recent years, but I continue on, probably because I’m not all that bright. I trust a free market to provide the best answers.

If an idea is a bad one, it needs to fail. If an idea is a good one, it needs to succeed. FatWallet appears to be a good idea for the moment. When confronted with unnecessary governmental interference, it responded in a perfectly legal way. The State of Illinois saw yet another opportunity to raise revenue, yet the consequence of its actions may prove to generate even less revenue. Time will tell. Perhaps one day, all of the states will be collecting taxes for activity that has taken place in another state, but it hasn’t happened yet. And if that day comes, how many entrepreneurs will simply move to another venue? Or not produce at all?

And, in related news, the VC (Venture Capitalists, not the Viet Cong) have discovered FatWallet.com. The company was purchased in early September by Ebates.

When words elude, leave it to the Austin Lounge Lizards to fill it in:

*****

Of course, in the fullness of time, patterns eventually become apparent. And, with that in mind, it is becoming apparent that all of the states will eventually be charging sales & use tax on Internet transactions. There’s too much money involved and there are too many forces pushing things in that direction. But this doesn’t change the fact that while laws may be passed, there are still ways to legally minimize their impact. It’s the logical free market approach……

You must be logged in to post a comment.